Today’s world is cutthroat. Small and medium-sized law offices are hustling to run efficiently while managing their budgets. However, one nagging snag keeps hindering their growth: accountancy issues. Wrestling with bank statements, chasing expenses, or generating invoices, these tedious tasks can occupy precious hours that should rather be dedicated to clients or expanding the firm.

That’s where AI can help in accounting. Automating your accounting process saves time and energy with custom AI agents that are tailormade for the major and minute workflows of finance and accounting. It’s a brand new opportunity for your giving law firm to shine.

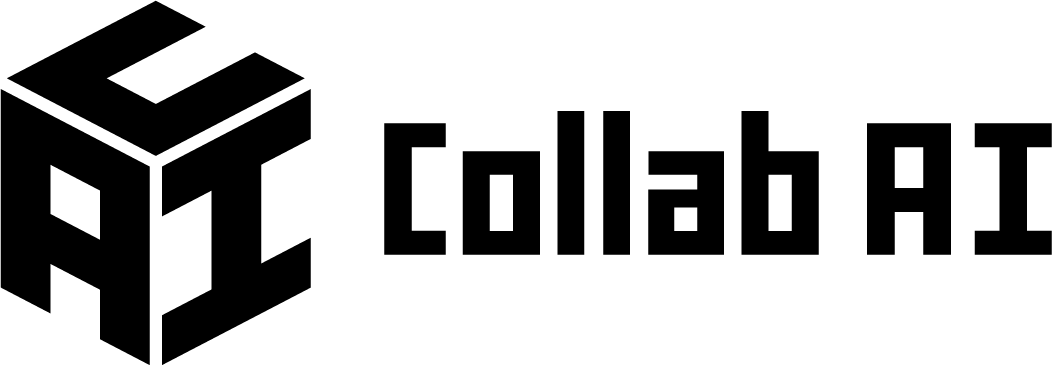

Accounting Bottlenecks are Many…

It doesn’t matter how skilled your legal team is; if the cash isn’t flowing smoothly, you hit a wall. Law firms wince at:

- Manual invoicing: Drafting, tracking, and following up on client invoices.

- Bank reconciliation: Matching every deposit and withdrawal with client trust and operating accounts.

- Expense classification: Rightly logging those numerous expenses for compliance, taxes, and billing clients.

For law firms without the luxury of a full-time accountant, these ‘easy’ tasks mount up, causing hold-ups, bill blunders, and lost chances to earn revenue.

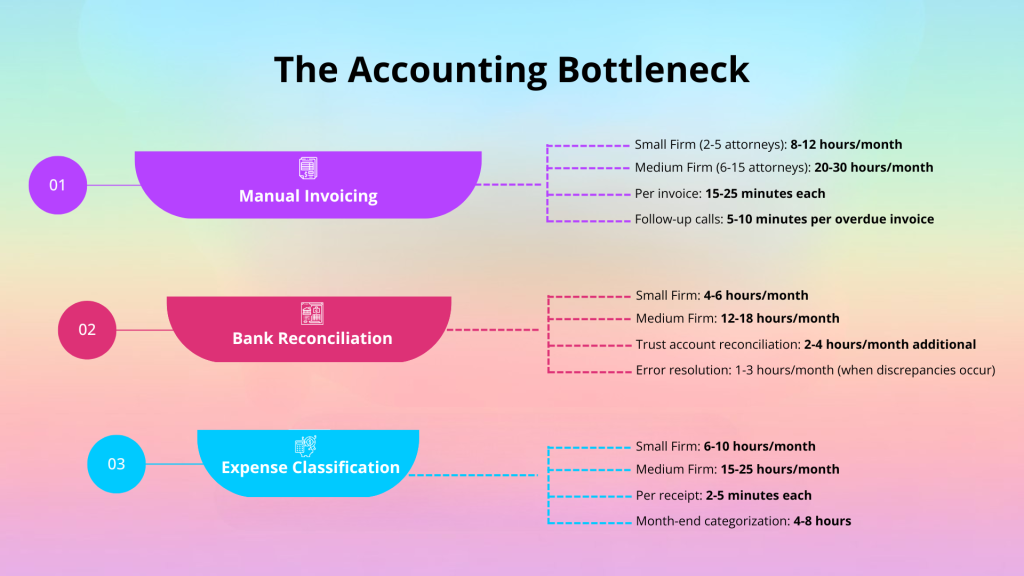

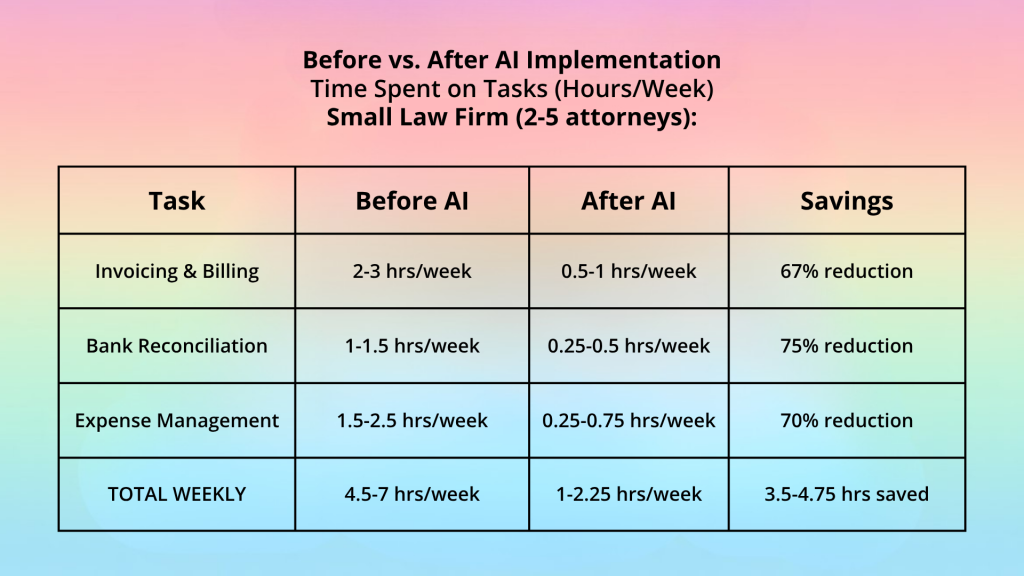

AI to the Rescue for Law Offices

Here’s how AI tools sweep away the old, cumbersome accounting ways:

1. Automated Invoicing

- Custom AI agents for accounting can auto-generate invoices as soon as billable hours are logged within a practice management system.

- It grabs case specifics, applies custom rates, and schedules recurring invoices for steady clients.

- It offers friendly automated reminders so you don’t fret about late payments, cutting down on those tricky follow-up calls.

2. Smart Bank Reconciliation

- AI agents can now sync with bank accounts and trust ledgers, keeping tabs on transactions as they happen.

- Instead of drowning in monthly statements, alerts give staff a heads-up on anything odd.

- This is invaluable for law firms, where keeping accounting honest is the gold standard.

3. Intelligent Expense Classification

- Custom AI agents for finance swiftly go through receipts and expenses.

- It sorts each according to its rightful place for accounts, clients, or taxes.

- Whether it’s an Uber to court or a legal database subscription tool, AI adds the right label on each expense and spares you the chore.

Mini-Case Studies: AI in Action

Case Study 1: The 10-Attorney Litigation Firm

A Boston litigation firm was swamped with bills each month until AI sliced their billing time by 70% and on-the-dot payments shot up, perking up cash flow and saving the team from nagging follow-ups.

Automated reminders:

- Increased on-time payments

- Improved monthly cash flow

- Reducing time spent by associates on non-billable follow-ups.

Case Study 2: The Solo Practitioner

A lone lawyer from Chicago, finally ditching paper receipts and Excel sheets, deployed a cloud-based AI expense management agent. What was once an end-of-the-month hurdle is now a seamless, daily process. Year-end tax prep and audits are faster and less worrisome.

The AI now:

- Scans e-mailed receipts

- Extracts relevant data

- Files them under appropriate client matters.

Case Study 3: The Multistate Immigration Law Firm

An immigration law office across three states used custom AI software to oversee bank reconciliations, linked directly to trust and operational funds. The CFO estimates savings of at least 16 hours a month, freeing time for strategic planning.

The AI:

- waves a red flag at suspect dealings

- Saves time

- Reduces the risk of fund mix-ups, which is a common violation.

Making the Shift: Action Items for Law Firm Leaders

- Start small: Zero in on the most painful manual process, be it invoicing, bank reconciliation, or expense logging, and get AI to take that on first.

- Choose legal-specific AI: Go for AI vendors and tools designed for law firm workflows and compliant with relevant bar association needs.

- Train your team: Ensure everyone knows how to use and benefit from the new systems.

- Monitor and optimize: Keep an eye on outcomes and adjust automation workflows for even smoother operations.

The Bottom Line

For small and medium-sized law firms, bottlenecks in accounting are a real choke point for profits and progress. AI-driven automation with custom agents in accounting and finance isn’t about eliminating jobs; it’s about lifting your team to greater heights by ditching the drudge work and sharpening client service. Early adopters report serious time and money saved and a mighty load off their minds.

Embracing AI in accounting can reboot your firm’s flow, making you competitive in the market. Now is the time to get rid of these bumps and let your practice focus on what matters the most – law and clients.