Tax season can feel like a storm cloud hanging over small and mid-sized businesses. It’s not exactly the time for relaxation, right? With the tangled mess of state sales tax rules, an IRS system that constantly seems to change, and the headache of 1099 reporting, many business owners find themselves losing sleep. All that manual work can seriously eat into the time you’d much rather spend on growing your business, and one little slip-up? Yeah, that can bring on audits or penalties that hit hard in the wallet. But guess what? In 2025, AI in accounting is here to turn that stress into ease.

The Pain of Compliance for SMEs

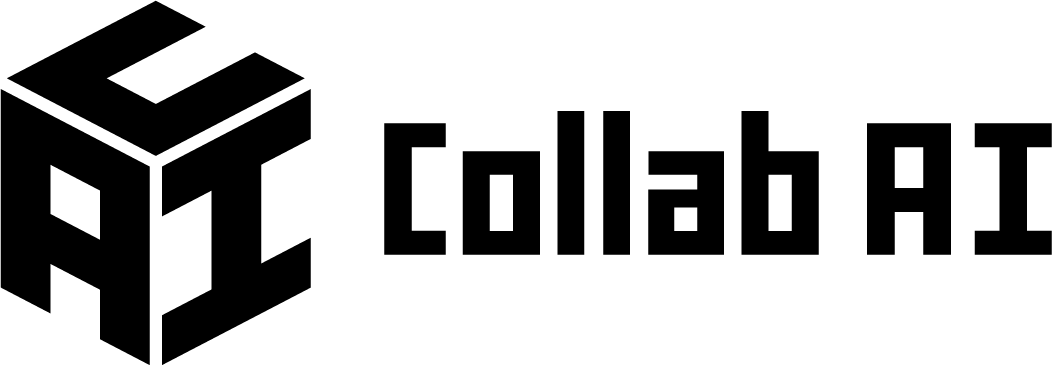

Small and medium-sized enterprises (SMEs) are trying to handle a head-spinning list of compliance tasks. They’ve got to manage sales tax registrations in a bunch of different states, keep up with the ever-shifting tax laws, categorize expenses accurately, and ensure that all their eligible contractors are issued their 1099s. It’s no surprise that navigating this maze alone can wear staff down and crank up the chances of making mistakes. Just think, thousands of small businesses get hit with alerts and penalties every year because they filed late or didn’t do it right.

- Sales tax: Seriously, there are over 13,000 sales tax jurisdictions across the US. Keeping track of where and when to collect, remit, and file is enough to make anyone feel overwhelmed.

- 1099 reporting: Even something as small as a transposed Tax ID can bring the IRS knocking on your door.

- Federal/state tax filing: Missing out on deductions or credits? It happens, especially when there’s a new regulation that not many people know about.

How AI in Accounting Automates Compliance

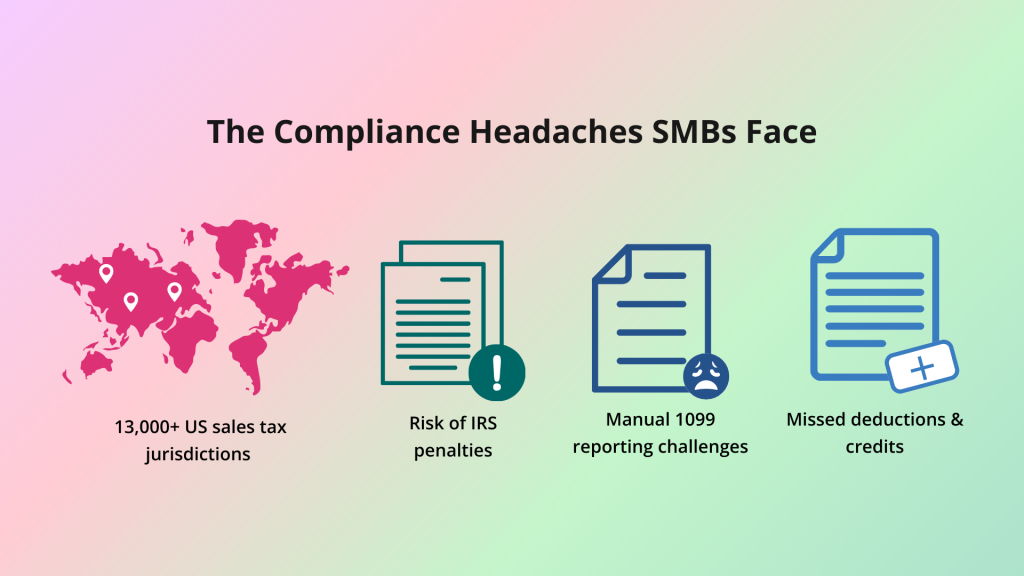

Modern, AI-powered accounting tools handle tons of data in real time, pulling out useful insights while taking care of the boring tasks for you. They’re really shaking things up in a big way. Here’s how AI is making compliance easy for businesses in 2025:

1. Sales Tax Compliance Made Simple

- Imagine AI tools swiping through your product listings, customer locations, and transaction histories to determine which sales actually require tax—and, oh yeah, how much you should collect.

- These smart platforms get constantly updated with tax rate changes, assign product codes for correct classifications, and even keep an eye on nexus so you know when you need to start collecting sales tax in a new state.

- Forget about those endless spreadsheets and unexpected tax bills—AI has your back from quote to cash.

2. Effortless 1099 and Information Return Filings

- We all know January can be chaotic for businesses scrambling to prepare and send out 1099s. But fear not, AI in accounting has got it covered!

- It keeps tabs on payments, figures out who needs a 1099, and prepares everything ahead of time.

- Plus, AI spots potential hiccups, like wrong Taxpayer Identification Numbers, way before the forms reach the IRS. Some business owners now find they’re spending just minutes on 1099 compliance instead of days.

3. Streamlined Tax Preparation and Filing

- These AI accounting platforms gather all your financial data and fill in federal and state tax forms for you. They show you any deductions you might have missed, check for inconsistencies, and alert you early on if anything looks off, so you can dodge those last-minute panics—and costly mistakes.

- AI tools can even offer personalized recommendations and run through different tax scenarios, plus keep tabs on regulatory changes.

- This adaptability helps ensure that US businesses stay compliant as tax laws keep evolving.

Staying Ahead of Changing Regulations

One of the real perks of using AI in accounting is having automated regulatory monitoring. These systems can constantly scan for updates on IRS rules or state tax laws and adjust your workflows without you having to lift a finger. So, no more stressing over each IRS update or trying to untangle new compliance bulletins. AI ensures your filings are always current and audit trails are prepped.

Success Story: Small Retailer in Texas

Take, for instance, a little retail shop in Dallas. They were struggling to keep their sales tax collection in check across Texas, Oklahoma, and a growing number of online sales states. Once they implemented an AI-powered accounting solution, they were able to:

- Automatically register for new sales tax permits as needed

- Get real-time alerts when they approached nexus thresholds

- Prepare and file accurate sales tax and 1099 forms on time every month

This shift cut down on penalty risks, eliminated late filings, and freed up weeks of staff time each year to get back to focusing on growth.

Why SMEs Should Embrace AI in Accounting

With the costs of noncompliance on the rise, both in dollars and reputation, it’s clear that small businesses need to consider AI in accounting. Here’s what it offers:

- Real-time accuracy for sales tax, IRS filings, and 1099s

- Automated alerts and error checks to cut audit risks

- Freedom from dull paperwork and late-night stress

- More time and energy to actually run and grow your business

In 2025, being compliant doesn’t mean you have to sacrifice growth or tranquility. With AI in accounting, small businesses can flip tax compliance from a heavy burden into a strategic advantage that supports their success.

Ready to Take the Stress Out of Tax Compliance?

We get it. GST, TDS, and all that tax stuff can really weigh down your small business. But it doesn’t have to! Reach out to us today, and let’s chat about how our smart AI in accounting tools can totally simplify your tax processes. We’re here to help make compliance easy, spot-on, and way less nerve-wracking.