If you happen to be part of a small or medium-sized business—or maybe you’ve got decision-making powers at a growing company—then the thought of bringing AI into your accounting process might feel a bit overwhelming. You might find yourself asking questions like, “Will this throw my whole routine off course?” “What’s the actual time and effort going to be for training my team?” or “Am I going to end up investing a ton into complicated systems?”

However, the truth is that integrating AI doesn’t have to be about completely overhauling everything. It’s more about making small, strategic moves that deliver immediate benefits while setting the stage for bigger automation later on.

Pinpointing the Real Struggles

For decision-makers like you in smaller businesses, daily struggles pop up that really eat away at productivity and resources. Just think about the hours that get drained on tasks like

- Typing in invoices by hand

- Reconciling bank statements

- Pulling together financial reports

All these tasks don’t just take away your time—they also sidetrack you from focusing on growth and strategic planning. And let’s not forget about the potential errors that come with manual work, throwing a wrench in your business operations, and creating stress with deadlines piling up. These bottlenecks can really hold back your scaling efforts.

This is exactly where AI-powered accounting solutions can swoop in to save the day. By starting with small, manageable changes, you can ease those pains and gradually build your confidence in this new technology.

How to Introduce AI Gradually in Your Accounting Workflow

Here’s how to introduce AI into your accounting workflows simple and easy:

Smart Document Parsing: Your First Step Forward

Think about this: bringing AI into accounting can kick off with something as low-key as smart document processing.

Instead of spending hours manually entering invoice details, why not let AI platforms handle the heavy lifting? They can easily extract vendor info, amounts, dates, and line items from scanned documents or PDFs.

Just by making this switch, you could shrink your invoice processing time by a whopping 80%. That means your accounting team can focus more on the exciting parts like analysis instead of dull data entry.

For smaller businesses dealing with tons of invoices each week, this means saving precious hours and reducing those annoying human errors. And the best part? Setting it up is a walk in the park, slotting right into your existing accounting systems—definitely a top-notch starting point for your AI journey.

Receipt Scanning: Making Expense Management a Breeze

Now, let’s talk about expense reporting, which can often turn into a real pain for smaller organizations. Thankfully, AI-driven receipt scanning can change that game. Picture this: Employees take a quick photo of their receipts on their smartphones, and boom! AI captures all the necessary details, sorts transactions, and even flags any breaches of your spending policies on the fly.

- Say goodbye to the hassle of paperwork.

- Wave farewell to reimbursement delays.

- Enjoy instant visibility into company spending.

These adjustments can create a pretty significant positive impact on your cash flow and employee satisfaction, making it a quick win for folks making decisions.

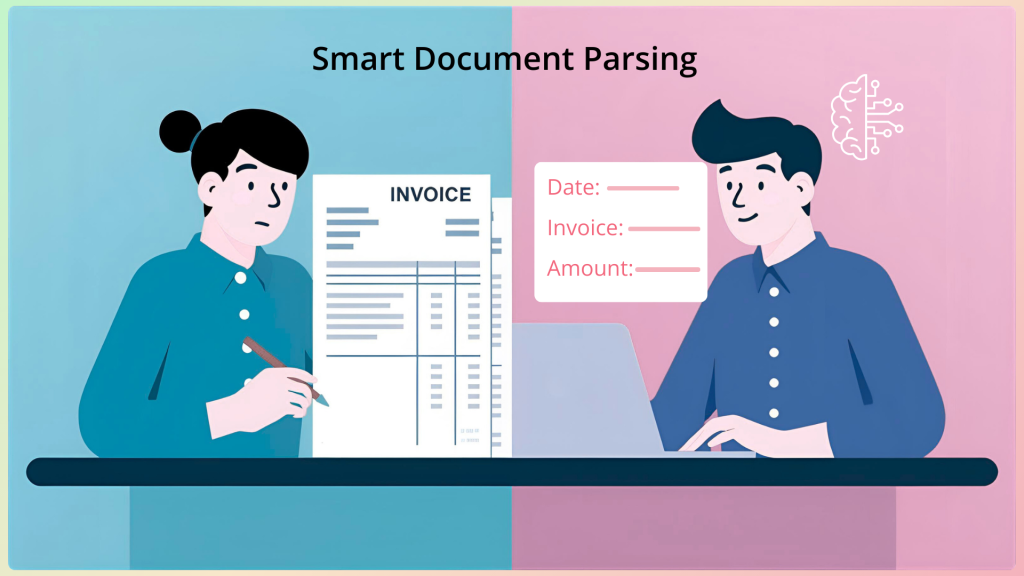

AI-Generated Financial Reports: Instant Business Insights

Now, think about how creating monthly financial reports usually devours your time. Well, with AI-powered finance tools, you can automatically whip up comprehensive financial statements, cash flow analyses, and performance dashboards.

These systems gather data from various sources, guarantee consistent formatting, and even highlight trends and anomalies.

For those of you craving timely financial insights to help in your strategic planning, this transforms a tedious task into a significant competitive advantage. Reports that once took days can now land right at your fingertips, allowing for quicker and smarter business choices.

Moving Toward Broad Automation

These quick wins lay the groundwork for diving into more advanced AI applications down the road. As your team grows more comfortable with the basics, you can start exploring the more complex territory.

Tax Compliance: Stay Stress-Free

AI platforms truly shine when it comes to tax compliance. They can easily categorize transactions, keep track of deductible expenses, and ensure accurate filings. Plus, they stay updated with regulatory changes, so you won’t have any last-minute panics at tax time and it reduces the chances of those costly mistakes that can set small businesses back.

Audit Prep: Quick and Easy

When audit season rolls around, AI systems will have your financial data neatly organized and analyzed from the whole year. They can create audit trails, spot discrepancies, and provide transaction histories in a flash. This means audits will be quicker, keeping professional fees in check and minimizing business disruptions.

Budgeting and Forecasting: Smart Financial Choices

On the sophisticated side, AI is great for handling predictive analytics for your financial planning needs. By sifting through historical data, market trends, and seasonal variations, it can generate spot-on budget forecasts and modeling scenarios.

For smaller businesses, this means you’re not just reacting anymore; instead, you can proactively plan strategies grounded in solid data rather than just hunches.

The Advantages of Gradual Implementation

Starting with little steps in AI is full of perks for smaller businesses. The risk stays low because each step is a contained experiment that you can easily reverse if needed. Staff members gradually adapt to the tech changes, so there’s no overwhelming pressure. And above all, every little success boosts organizational confidence and highlights a clear return on investment, making it easier to justify a deeper dive into the world of AI.

This slow-and-steady approach leaves room for both personal and organizational learning, allowing your team to spot even more chances for efficiency as they get comfortable with the basic AI tools. This kind of organic growth keeps AI adoption more tied to practical business needs rather than just the capabilities of the tech itself.

Taking the First Step

So, if you’re on the lookout for some expert help to make sense of AI in your accounting workflows, don’t hesitate to reach out to CollabAI. Our tailored, AI-powered accounting solutions can assist smaller businesses in taking practical steps toward automation that saves time, cuts down errors, and opens up new windows of financial insights.